Toyota Financial Services

New customer portal

Transformative digital roadmap

To provide best-in-class customer-centric financial services to a wide range of customer demographic and needs, TFS embarked on a digital transformation journey with BBT.

Financial products are complex, and variables like loan conditions, customer needs and macroeconomic factors contribute to hyper-personalised offerings.

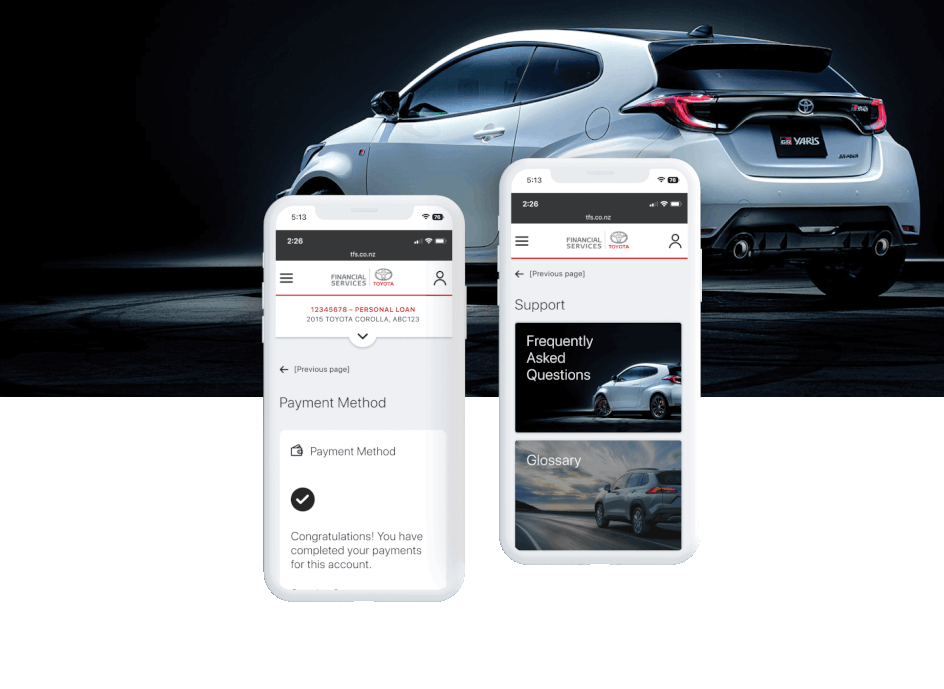

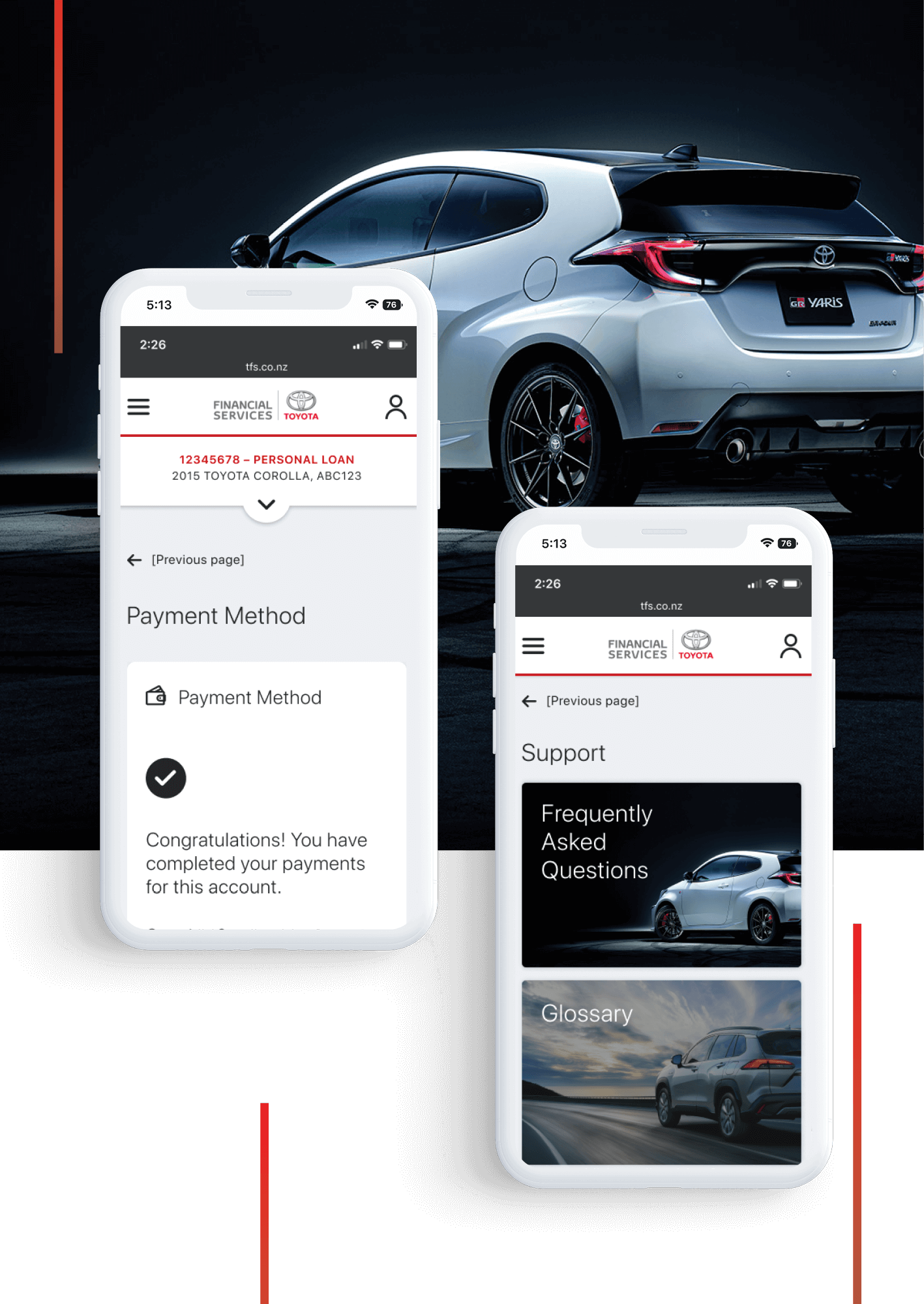

In the multi-phased roadmap, the immediate job was to resolve their customer pain point of personal data access. The challenge for the teams at TFS and BBT was to create a digital solution that enables customers to 'self-serve' their most common requests while ensuring it is accessible, intuitive and easy to use.

With a diverse range of customers, the web solution needed to be easily accessible and user-friendly for everyone. In a practical sense, this meant keeping the design simplistic yet modern and on-brand, pairing back decorative components to declutter. Where possible, we added a local touch to the global brand, such as the graphical features of New Zealand's iconic landmarks.

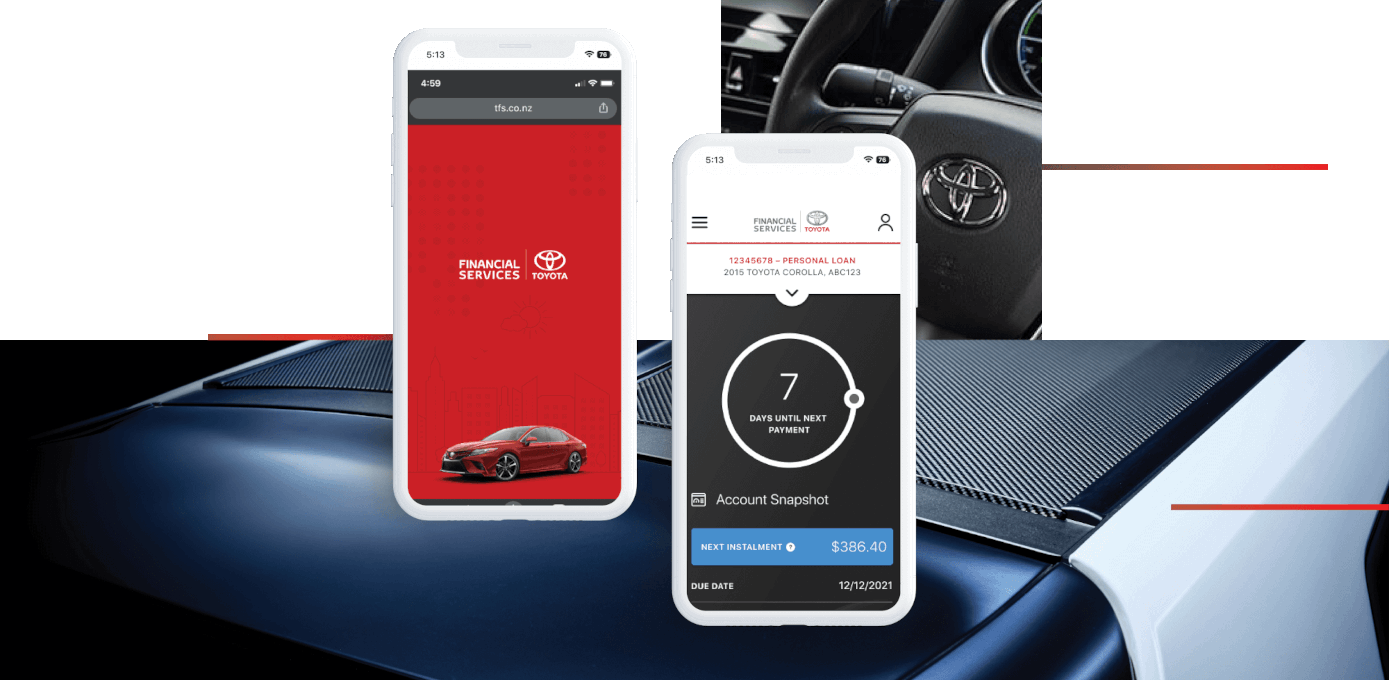

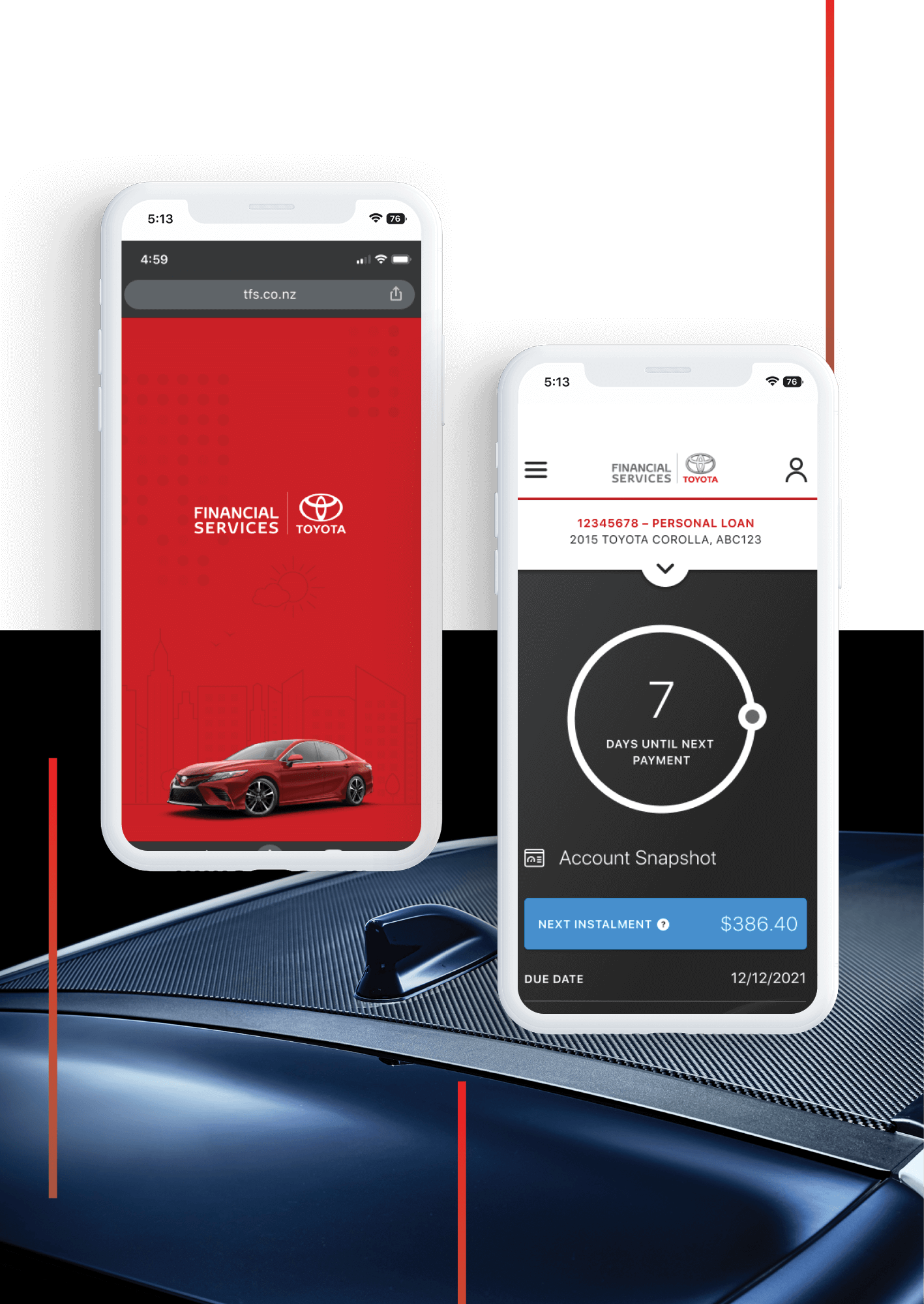

For customers that use multiple TFS products, we designed the dashboard to show all loans at a glance, allowing users to easily toggle and see more detailed information. In addition, the dashboard components are stackable and optimised for every screen size, the buttons are touch-friendly, and we used high-contrast colours to assist with readability.

In the initial stages of development, both an app and a web-based solution were considered. Then, factors like costs, speed-to-market, device compatibility, customer usage frequency and behaviour were balanced to create an agile digital product that can integrate with the current ecosystem.

The solution: a web-based customer-facing retail portal employing a best-in-breed tech stack.

Our products and development team worked closely with TFS to create a customer dashboard that simplifies the intricate nature of financial products, enabling customers to gain clear visibility of factors like interest rates and repayment conditions. The web-based application integrates with TFS’ internal finance system allowing customers to easily pull up the information they needed in real-time, and make edits and changes without the need to contact customer service.